iowa inheritance tax rates 2020

50001-100K has an Iowa inheritance tax rate of 12. For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

An exemption from Iowa inheritance tax for a qualified plan does not depend on the relationship of the beneficiary to the decedent.

. These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. For persons dying in the year 2022 the Iowa inheritance tax will be reduced by forty percent. There are a number of categories of inheritor for the inheritance tax but only two are relevant for individuals.

Over 100000 to 150000. Property passing to children biological and legally-adopted children stepchildren grandchildren great-grandchildren and other lineal descendants is. In 2023 the tax rates below will be reduced by 60.

Especially if your total assets approach 5 million or more the possibility of being subject to estate tax rates as high as 40 percent can be a compelling reason to consider land. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. Iowa Inheritance and Gift Tax.

Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent. Learn About Sales. Brothers and sisters half-brother and sisters and sons and daughters-in-law pay 4 on the first 12500.

The good news in light of all this tax talk is that Iowas inheritance tax only applies in certain situations. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code section 450101-4 are reduced by 40.

What is the federal inheritance tax rate for 2020. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. If the net value of the decedents estate is less than 25000 then no tax is applied.

Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law and the rate is 5 to 10. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance.

What is Iowa inheritance tax. Report Fraud. Read more about Inheritance Tax Rates Schedule.

Iowa inheritance Tax Rate B 2020 Up to 12500. Over 75000 to 100000. Register for a Permit.

Not every Iowan who passes away will render their heirs subject to more taxes. The percentage increases as the. And in 2024 the tax rates below will be reduced by 80.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. The following Inheritance Tax rates will apply to a decedents beneficiary who is a. For instance Iowas inheritance tax does not apply if the estate is valued at 25000 or less.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Adopted and Filed Rules. In 2013 the Indiana legislature repealed their inheritance tax completely.

0-50K has an Iowa inheritance tax rate of 10. Inheritance tax in Iowa is based on the heirs relationship with the deceased. 100001 plus has an Iowa inheritance tax rate of 15.

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. File a W-2 or 1099. For more information on exempt beneficiaries check out Iowa Inheritance Tax Law Explained.

The rate ranges from 5 to 10 based on the size of. See Iowa Code section 4504. Aunts uncles cousins nieces and nephews of the decedent.

While there is no state estate tax in Iowa. The following among others are exempt from Iowas. Subject to Iowa inheritance tax.

If instead you are a sibling or other non-linear ancestor then you are subject to pay an inheritance tax on your portion. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. What is the inheritance tax 2020.

A summary of the different categories is as follows. Iowas inheritance tax is paid by the beneficiary. It is most common for Iowa inheritance tax to be due when estate shares are left to non-lineal relatives of the decedent such as brothers sisters nieces nephews aunts uncles or cousins.

Land protection may reduce the value of your land which in turn reduces the value of your estate and may reduce your federal estate tax and state inheritance tax. Spouses children and even parents were already excluded from paying the inheritance tax while nieces. See In re Estate of Heuermann Docket No.

For deaths occurring on or after January 1 2025 no inheritance tax will be imposed. In 2022 the tax rates listed below will be reduced by 40. The estate tax is a tax on a persons assets after death.

The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5. In 2013 the Indiana legislature repealed their inheritance tax completely.

Estate tax rate ranges from. This is for siblings half-siblings and children-in-law. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Iowa was one of just six states in the country to still impose an inheritance tax. What is the federal inheritance tax rate for 2020. Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20.

Property inherited by a spouse parent grandparent child grandchild or other direct lineal descendent is exempt from Iowas inheritance tax. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be. Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

Value of inheritance. In 2021 the tax rates listed below will be reduced by 20. That is worse than Iowas top inheritance tax rate of 15.

Tax Rate D and Tax Rate E beneficiaries are for various types of organizations. Get Access to the Largest Online Library of Legal Forms for Any State. On May 19th 2021 the Iowa Legislature similarly passed SF.

Over 25000 to 75000. Track or File Rent Reimbursement. Payments under a qualified plan made to the estate of the decedent are exempt from Iowa inheritance tax.

In 2020 federal estate tax generally applies to assets over 1158 million. Change or Cancel a Permit. How do I avoid inheritance tax in Iowa.

Property passing to parents grandparents great-grandparents and other lineal ascendants is exempt from inheritance tax. Up to 25 cash back For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. Read more about IA 8864 Biodiesel Blended Fuel Tax.

The applicable tax rates will be reduced an additional 20 for each of the following three years. Learn About Property Tax. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

Over 12500 to 25000. The applicable tax rates will be reduced an additional 20 for each of the following two years.

We Used Data And Science To Determine The Whitest States In America States In America America States

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Taxes On Your Inheritance In California Albertson Davidson Llp

Don T Die In Nebraska How The County Inheritance Tax Works

Iowa Estate Tax Everything You Need To Know Smartasset

Berkshire Hathaway Homeservices Penfed Realty Homes For Sale Mid Atlantic Real Estate Housing Market Real Estate Marketing Colorado Real Estate

Iowa Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Inheritance And Gift Taxes In Europe Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs

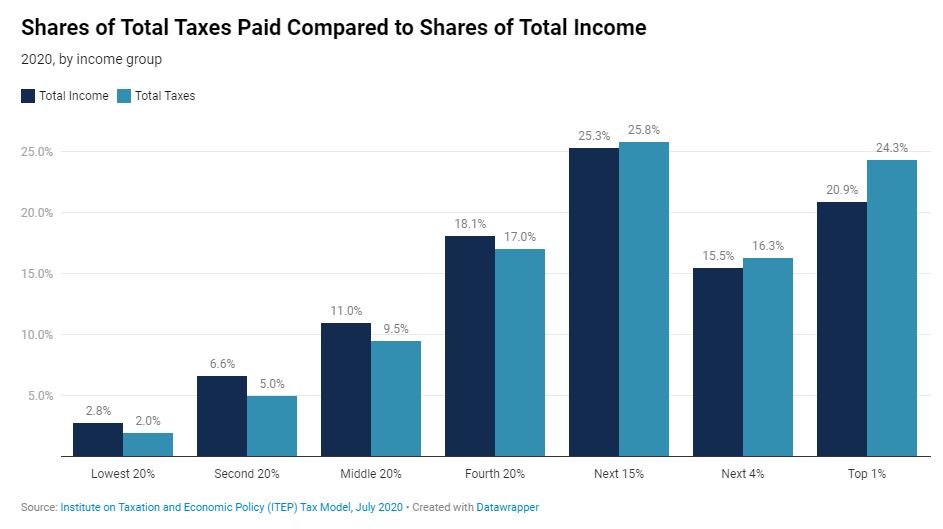

Who Pays Taxes In America In 2020 Itep

Anil On Twitter States In America America States

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Texas State Taxes Forbes Advisor

Riverside County Ca Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)